Sunday 1 January 2023: Traders’ Handbook of Economic Cycles – Chapter 2: The Kitchin Cycle

In the below series of articles, I introduced the Kitchin Cycle and, in real time, we successfully navigated the major swings from the latter half of 2021 until the end of 2022:

A Short Word on Cycles: Sunday 11 July 2021 | by Kudakwashe Chinhara | Medium

A Short Word on Cycles Part 2 — The Kitchin Supremacy: Monday 4 July 2022 (substack.com)

A Final Public Word on Cycles: Tuesday 11 October 2022 (substack.com)

In this chapter, I will extend the analysis to the next few years as we continue to build the cyclical picture for the remainder of this decade, one cycle/chapter at a time.

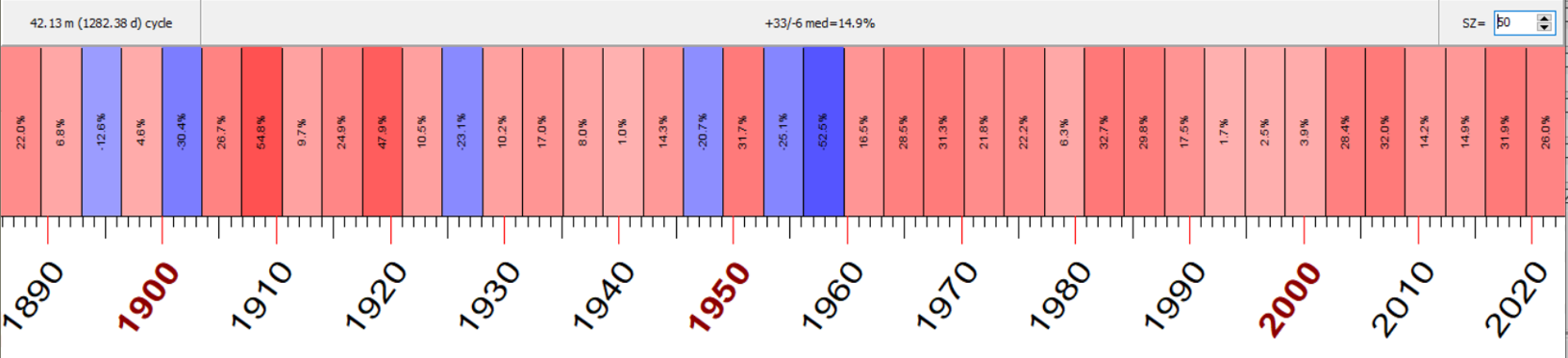

The importance of the Kitchin Cycle is illustrated by the following Walk-Forward-Analysis report:

It shows that in 33 out of 39 instances, a positive correlation existed between the projection of the FUTURE price-oscillator based on the cycle and the EVENTUAL realization of said oscillator. This is a remarkable result.

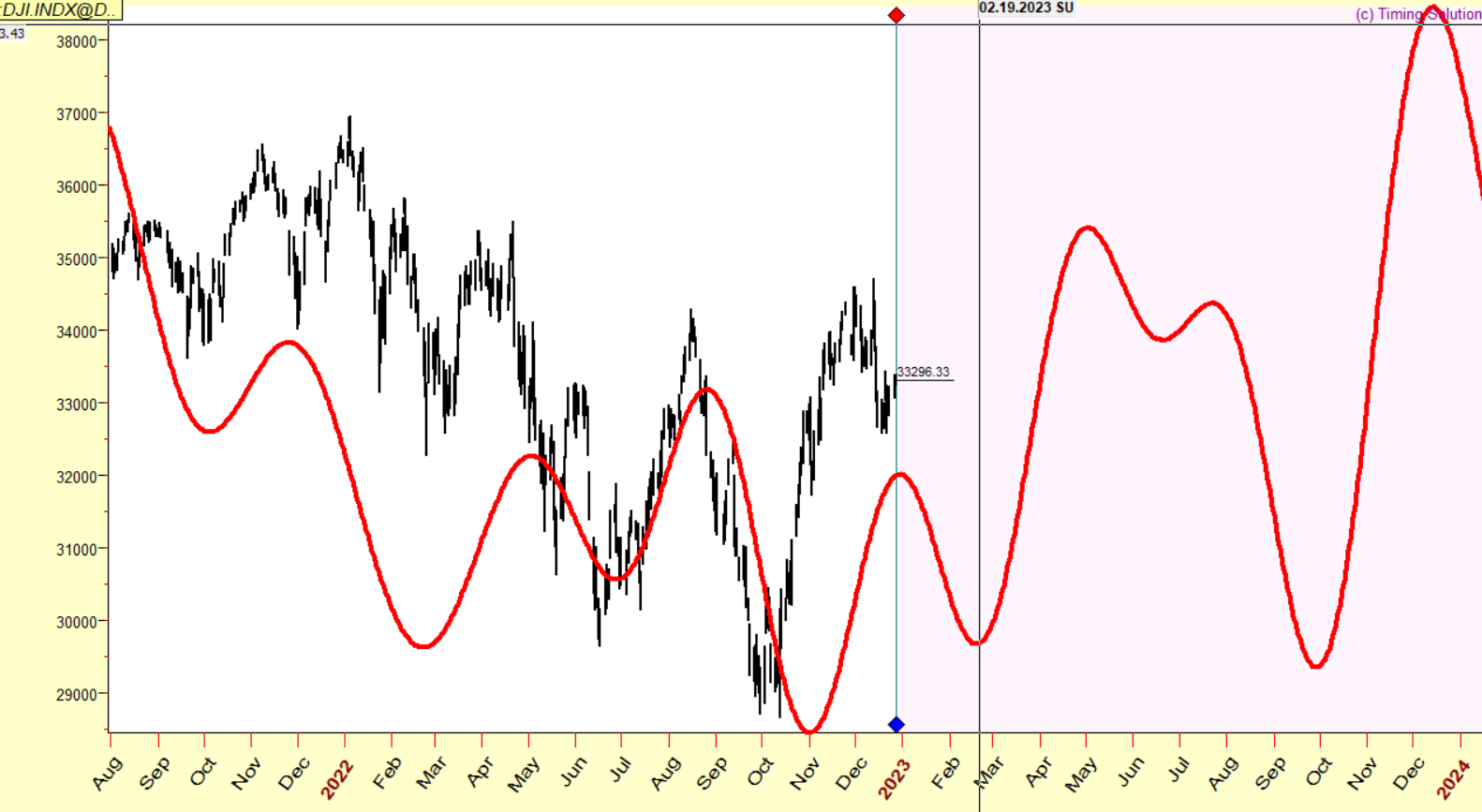

It appears that late-2022 saw the most recent major cycle-beat and if so, the next beat will be sometime around January to June 2025. That means the next 21-24 months could experience cyclical tailwinds.

Therefore, as with the Presidential Cycle, I expect 2023 and 2024 to experience rising stock prices. In fact, the Kitchin Cycles suggests beats in Feb/March 2023 and Sep/Oct 2023 which would be dips to buy. In other words, corrective price action in the 1st and 3rd quarters would temporarily halt an uptrend.