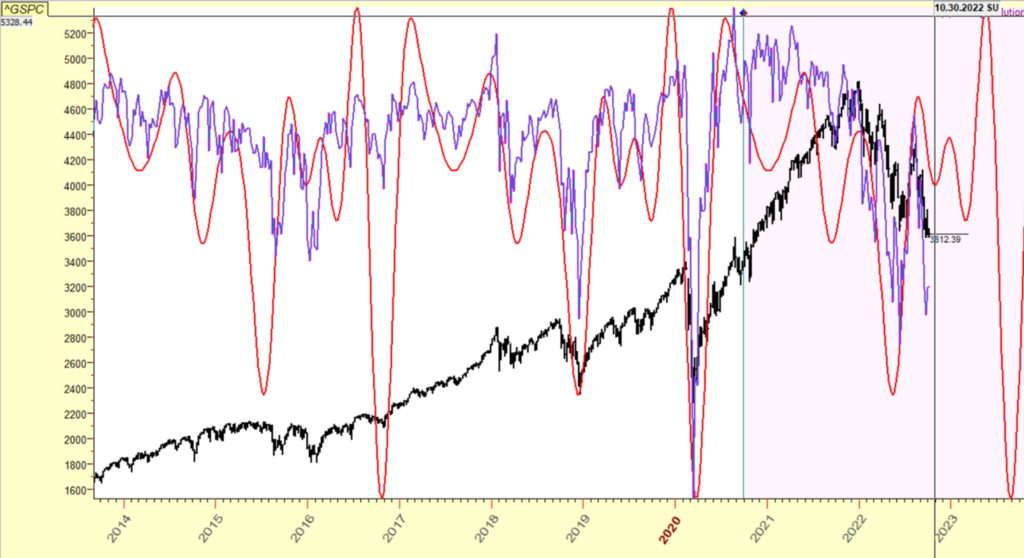

· Three months ago in this note, A Short Word on Cycles Part 2 — The Kitchin Supremacy: Monday 4 July 2022 | by Kudakwashe Chinhara | Medium, a cycle beat in Dec22/Apr23 was identified as a period into which a “potential violent decline” would progress, following a brief bear-market rally.

Having witnessed such a bear-market rally and a subsequent drop to new lows, it is now time to update the model with new data and see if we can draw further insights.

Interestingly, we see that the window for our cycle beat should have an early start, namely late-October. In other words, a low of some importance could be made this month. How much importance? Enough for me to switch to a paid subscription model for this type of analysis and enough for me to be taking profits across the board. There are very credible scenarios in play that could see a resumption of the bull market this year or next, which will see the markets head to new highs prior to The Bust that most market pundits are calling for right now!

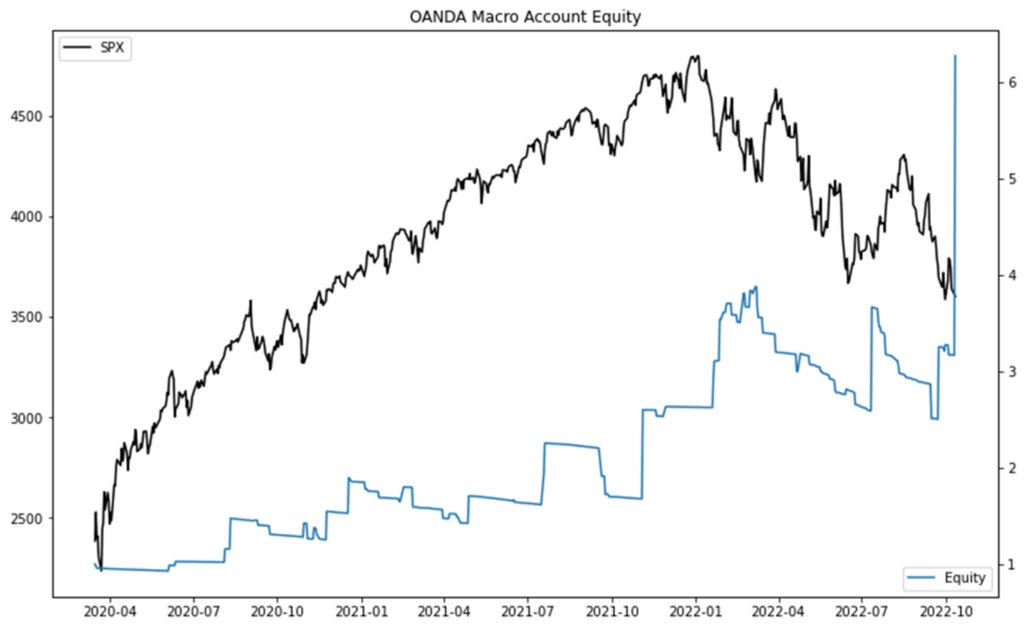

FYI the Equity line does not strictly represent daily Mark-to-Market but the account balance based on when trades are closed out. The former has been at least as volatile as the SPX in the last several months given a core short in stocks, bonds, oil and foreign currencies.

· If you would like to continue receiving such research with more frequent updates and real-time/specific trades that I am making, contact me on kudakwashe.chinhara@gmail.com. The remainder of this decade is very likely to be filled with once-in-a-generation opportunities as the major long-term cycles assert their dominance and confound the vast majority of economists/experts.