Joseph Kitchin

The Kitchin Cycle, named after the British economist and geographer Joseph Kitchin, is a concept that describes a short-term economic cycle with a typical duration of around 3 to 5 years. Kitchin introduced this idea in the 1920s based on his observations of economic data.

The cycle is primarily associated with fluctuations in inventory levels and production. According to the Kitchin Cycle, there is a repetitive pattern in which businesses, over a relatively short time frame, adjust their inventories in response to changes in demand. When demand increases, businesses produce more and build up their inventories. Conversely, when demand decreases, businesses reduce production and draw down their inventories.

Critics argue that the Kitchin Cycle is not as robust or consistent as longer-term economic cycles like the Kondratieff waves or Juglar cycles. Some economists question the statistical basis and relevance of the Kitchin Cycle, and it is not as widely accepted as other economic cycle theories. They are all WRONG!

Today’s exercise will demonstrate why investors/traders MUST track the Kitchin Cycle intimately.

Step 1

Download SPX price history until March 2009. This will be the training data to which we will fit a model using the Kitchin Cycle. We will use the model to forecast the SPX until the present day and make comparisons.

Step 2

Run the TS Sprectrum module which reveals a strong periodicity of 41.9 months i.e. The Kitchin Cycle

Step 3

Project a committee of the Kithin Cycle into the future i.e. a sinusoidal wave with a 41.9-month periodicity with varying inputs (stock-memory and overtones).

The wave depicts the rhythm of businesses responding to rising demand by ramping up production & inventories, and falling demand by reducing production and drawing down inventories. The green background marks the in-sample period, while the red marks the out-of-sample period (post-2009 low).

Step 4

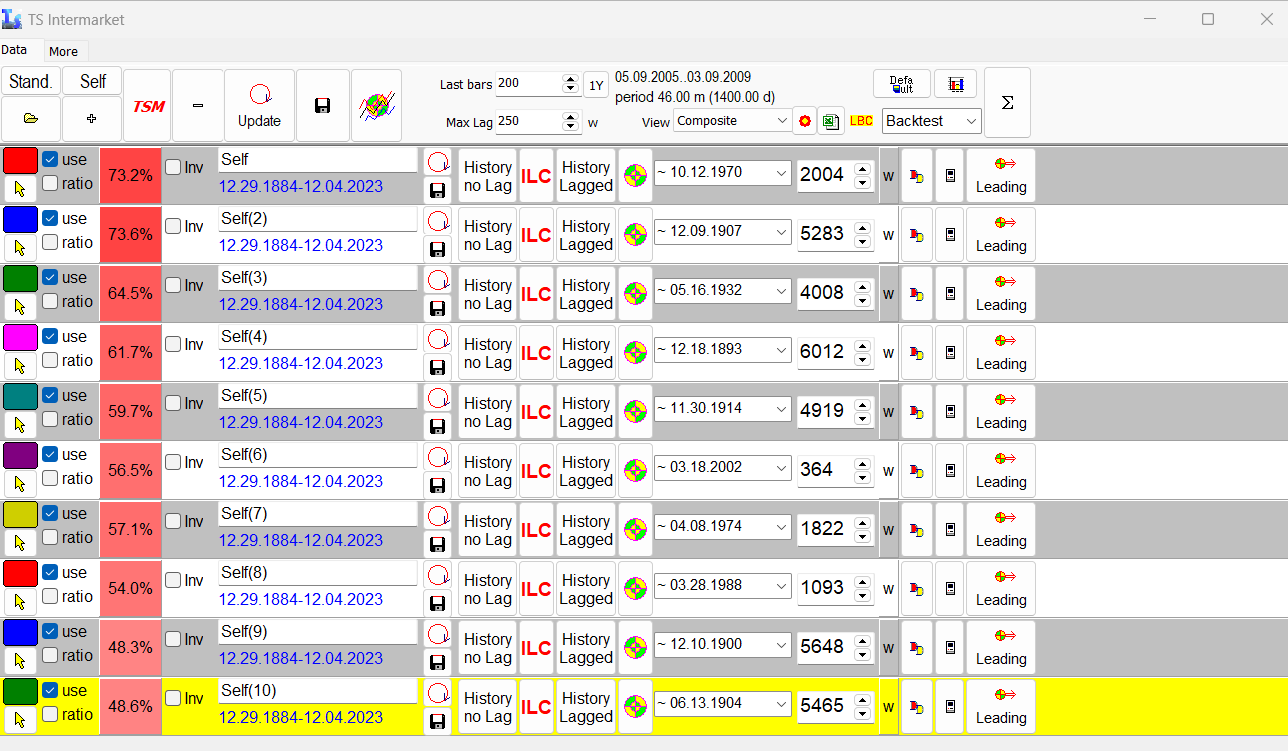

Take lagged versions of the SPX price history with lag parameters that are multiples of 41.9 months, and construct a composite index with the top 10 ranked by correlation over the last instance of the Kitchin Cycle i.e. late-2005 to early-2009 period. You can see the inputs below:

Step 5

Plot the projection from the above composite lag chart and the realized SPX side by side.

Post-fight recap

Do you understand what I have done?

Do you see the rhythm? Notice how the projection forecasted late-2011, early-2016, late-2018 and late-2022 lows a.k.a cycle beats that interrupted an uptrend. If you were trading during the test period you definitely remember:

The summer-2011 correction

The pair of corrections in late-2015

The 2018 Christmas meltdown

The 2022 bear-market

Each occurred at roughly the same time on a clock (let us call it midnight or the Spring Equinox for convenience). That clock is called The Kitchin Cycle which, as described in the introduction, was discovered in 1920!

I used data up until March 2009 to refine/re-tune said clock, and each one of those subsequent major corrections occurred into midnight, and the market bottomed shortly afterwards. Make sense?

Incidentally, the Walk Forward Analysis report below for the DJIA since 1890 illustrates this type of procedure. A 1-step ahead forecast is made starting with only a few years of data, and the process is repeated until the present. The red blocks show periods when the forecast worked and vice versa for the blue.

In the archives you will see how I used the Kitchin Cycle, among others, to successfully navigate the period from late-2021 until now:

Prepared in July 2021 and sold the 2021 bull market highs https://kudakwashe-chinhara.medium.com/a-short-word-on-cycles-sunday-11-july-2021-5ac109ff5d9

Avoided the weakest corners of the market during the 2022 rout https://medium.com/@kudakwashe-chinhara/did-red-friday-kill-the-bull-market-saturday-27-november-2021-507c3e558e38

Bought the July 2022 low https://kudakwashe-chinhara.medium.com/a-short-word-on-cycles-part-2-the-kitchin-supremacy-monday-4-july-2022-69c66bf34265

Bought the October 2022 low and sold the high prior https://kudakwashe-chinhara.medium.com/a-final-public-word-on-cycles-tuesday-11-october-2022-c38bcc8b12ef

Forecast for the remainder of the 2020s

Stay tuned for a video.

Fascinating stuff. Thanks for the post

Looking forward to the video!