Monday 1 May 2023: Dow Heatmap, Levels and Scenarios

We now have our answer to the question regarding the mid-month April cluster asked here:

Tuesday 25 April 2023: A Preview of May 2023 from the Cycles

Earlier this month we dove into the concepts of Time Counts and Transient/Dominant Cycles: 14 - 20 April was identified as a cluster of dates to watch for a potential “trend change or pause”. Also, it was suggested that “

As a reminder:

“The clusters command more of my attention. As the scenarios in the chart above suggest, the final cluster in _____ (which falls at the end of a negative APZ) could mark some form of bottom/pivot. Prior to that, a peak would come in at one of the earlier clusters. Incidentally, the first three months of this year have seen the mid-month dates resonating more with trend changes:

Mid-Jan: trend-interruption (-4% on DJIA and SPX)

Mid-February: trend-change

Mid-March: trend-change

Mid-April: trend-interruption or trend-change?”

The answer is obviously “trend interruption”, as the markets have or are close to registering year-to-date highs, after correcting by ~3%.

Recall that we were expecting momentum peaks in said cluster and then some form of market peak some time in May, as discussed here:

Tuesday 4 April 2023: Traders' Handbook of Economic Cycles - Chapter 8: Time Counts and the Transient Nature of Cycles

Lifespan of Cycles All cycles have a finite lifespan, meaning that they are born, they exist, and eventually they come to an end. Therefore, it is important to question the time span used to identify cycles in the stock market. It is a well-established scientific fact that there are no consistently profitable cycles in the market. Long-term cycles such as the Kitchin and Juglar cycles can be identified using mathematical procedures, but they are too lengthy for most traders traders.

Especially:

“Notice the close alignments with lows in the market or the oscillator in the lower panel. If this cycle remains hot for one more recurrence, momentum peaks would likely be registered in mid- and late-April (11th to 25th). That would then be followed by an actual market peak some time in May prior to a consolidation or reversal leading to a low in early-June. This is entirely consistent with our heatmap, which is constructed with completely different methods. It also helps us along with the concept of Time Counts to prepare for opportunities to take profits and or buy further dips if the thesis continues to hold.”

In fact, the market bounce of the proposed support in the first chart in Tuesday 25 April 2023: A Preview of May 2023 from the Cycles, and the reaction has been swift. Ahead of a big week on the economic calendar, we will now refine the game-plan discussed in said report.

Game-Plan Refinement

Various techniques give us a target ranges of 34,600 - 35,100 in the Dow and 4,245 - 4,300 in the SPX. If, when and how we get there requires us to dive into the Heatmap et al.

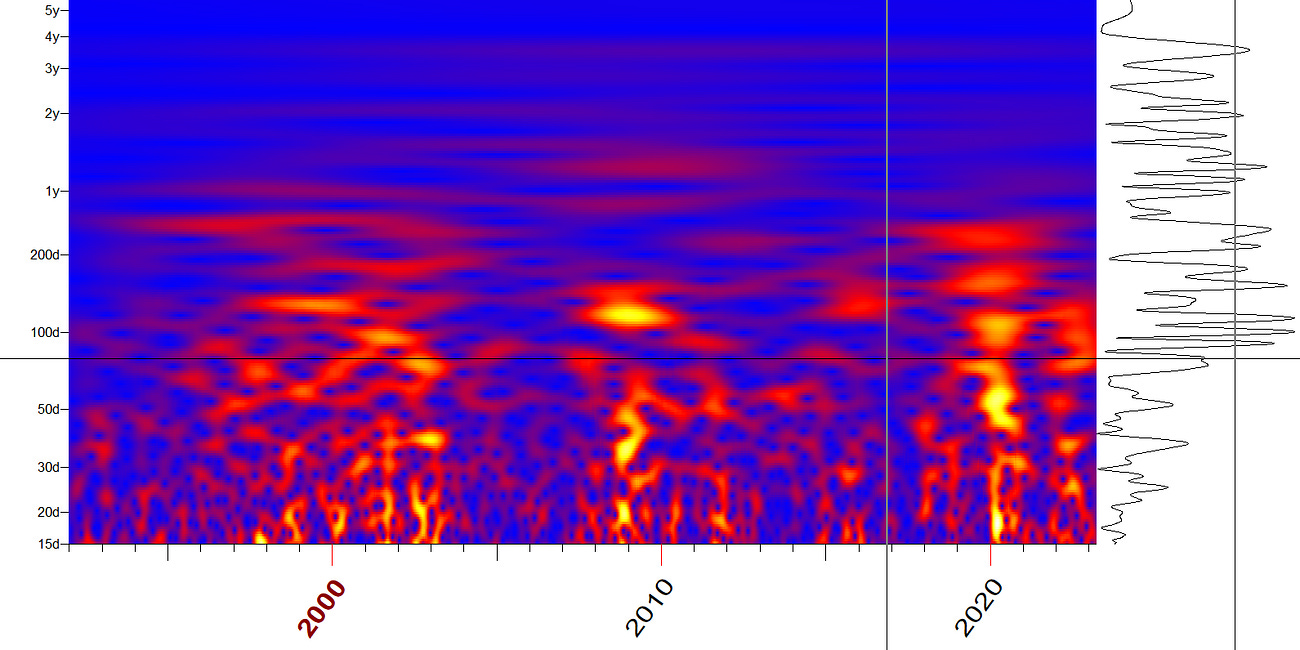

1. Heatmap and Ensemble Forecast

Below I have shown the Heatmap out to the end of June. First of all, you can see why I was so bullish for the late-March to early-May period (and by extension, bearish into late-Feb/mid-March). Now look at the picture for May and pay extra attention to LTC4 which I have highlighted (this is year-to-date the path with both the highest correlation AND lowest mean squared error between the forecast and realised path: