The Corruption of Economics

You must understand that mainstream Economics is UTTERLY and COMPLETELY WRONG. That is because the discipline has been deliberately and systematically corrupted since the early 1900s. We need to re-educate ourselves with the most basic knowledge of the Classical Economists of old. Once you have this knowledge, it is easy to see why Economics HAD TO be corrupted (more on this in subsequent posts):

On our investing journey, this will enable us to know when to invest (in real estate and stocks) aggressively, and when to stand on the sidelines. Poor timing can wipe you out or lead to a missed opportunity because economic progress occurs in often volatile cycles around an upward trend.

The most important of these cycles (IMHO) has seen an Economic Depression or Financial Panic occur every 18-19 years, on average, since the late 1700s. This is also known as THE Boom & Bust Cycle.

This reprinted classic from 1947 will introduce you to a new way, in fact, THE way to think about the economy and financial markets. You could explain this framework to a child or your grandmother, and they would begin to understand the economic machine more than most Ph.D. economists. (If you search the web, you will find a free PDF version of the book).

Dewey has this to say:

“The welfare of an individual is often determined by the time in which he was born. If he is old enough to start business at the low of a building cycle, which is accompanied by a falling value of gold and rising prices, his chances for success are very good. Conversely, if he is born at such a date that he starts in business at the peak of a building cycle, which is accompanied by falling commodity prices, his chances of success are small. Much of the success or failure of an individual is due to forces over which he has no control; but if he understands these forces, he may protect himself from the worst results of unfavourable combinations and profit personally from favourable combinations.”

Boom turns to Bust

Your investment strategy hinges on securing large gains during the upswing of a business cycle and avoiding irrevocable drawdowns during a downturn. At any point on your journey, you MUST NOT be the one asking the question that follows.

“Why did nobody see it coming?”

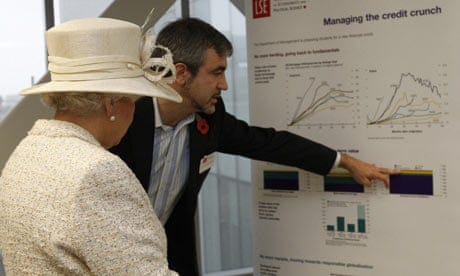

This is the question that was asked on the 5th of November 2008 by Queen Elizabeth. Accompanied by Prince Philip, she visited the London School of Economics and Political Science in order to open the New Academic Building on Lincoln’s Inn Fields in Central London. It was the first visit to the LSE by a reigning monarch since her grandfather, George V, laid the foundation stone of the “Old Building”.

What exactly was the “it” that nobody saw coming? If you are too young to remember, the world essentially ended in 2008. Everything came to a standstill during a time that we now call by many names: The Global Financial Crisis and The Credit Crunch are two popular titles. Am I being too dramatic? No. Three years earlier, I had graduated from the LSE and had since become an options trader at an American investment bank called Goldman Sachs. I was at that time responsible for managing a large European Volatility book, which is a fancy way of saying I was managing a book of contracts that various types of financial institutions use to bet on or protect themselves from sudden or adverse movements in stock prices. So as the stock markets crashed around the world, I was right in the thick of things with a front-row seat to the carnage. There were weekends spent in the office wondering if the financial markets or the banks would be open for business on the following Monday morning. The stress in the system was so great that global trade was starting to seize up, simply because businesses were not sure if they would be paid for the goods.

Back to the point; the Global Financial Crisis of 2008 turned out to be the worst economic depression since THE Great Depression of the 1930s. On her visit, the Queen asked the only logical question one should have after such an event; it was the question EVERYONE had. Many hard-working people suffered immense losses on their retirement accounts. Many retirees had to come out of retirement.

Did They Lie To The Queen?

In standard fashion, a massive team of “experts” was assembled to answer the Queen. Here is a link to their response.

Here is a summary of their conclusions:

“In summary, Your Majesty,” they conclude, “the failure to foresee the timing, extent and severity of the crisis and to head it off, while it had many causes, was principally a failure of the collective imagination of many bright people, both in this country and internationally, to understand the risks to the system as a whole.”

Besley stressed that the experts had not been in “finger-wagging mode” and had agreed that the causes of the credit crunch were extremely complex. “There was a very complicated, interconnected set of issues, rather than one particular person or one particular institution.”

In fact, on a tour of the Bank of England four years later, an economist and one of the Bank’s top financial policy experts, stopped the Queen to say he would like to answer the question she first posed to academics at the London School of Economics at the height of the financial crisis in 2008. Said economist told Her Majesty that financial crises were a bit like earthquakes and flu pandemics in being rare and difficult to predict, and reassured her that the staff at the Bank were there to help prevent another one. “Is there another one coming?” the Duke of Edinburgh joked, before warning them: “Don’t do it again.”

These responses were garbage at best, and outright lies at worst. Several economists, across three continents, had made very public forecasts and warnings as early as the late 1990s about exactly what would happen and when. These warnings included published books and video interviews, but one of these legends went even further. In the late-90s, he wrote a letter to then-UK Prime Minister, Tony Blair and Chancellor, Gordon Brown, warning them of what would happen in 2008 if they did not take preventative action. Obviously, the Queen did not see that letter.